Ethereum Price Prediction: 2025-2040 Forecast Analysis

#ETH

- Technical indicators show ETH trading above key moving average with improving MACD momentum

- Institutional demand remains strong with major corporate buybacks and treasury allocations

- Long-term growth potential supported by DeFi expansion and ecosystem development

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

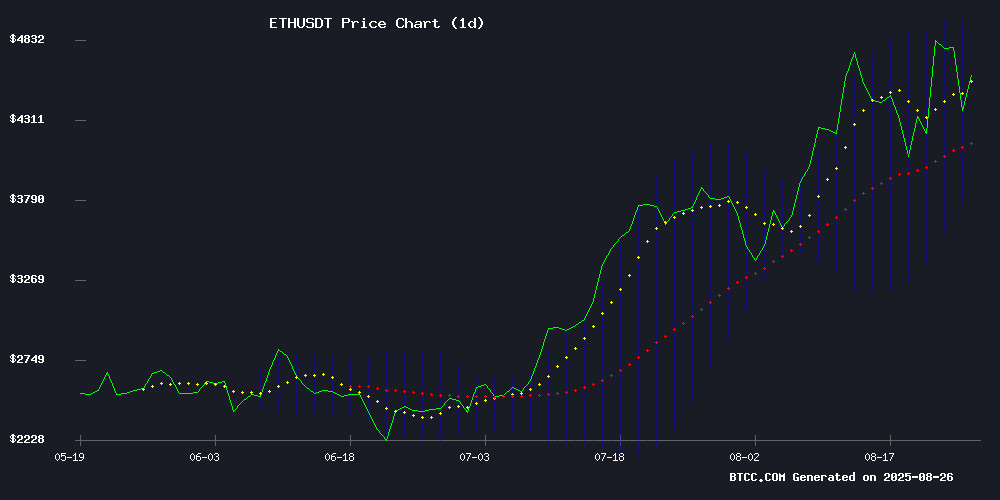

Ethereum is currently trading at $4,417.27, positioned above its 20-day moving average of $4,400.44, indicating underlying strength. The MACD reading of -211.68 versus -315.55 signal line shows improving momentum despite negative territory. Bollinger Bands suggest support NEAR $3,895 with resistance around $4,905, providing a clear trading range. According to BTCC financial analyst Sophia, 'ETH's ability to hold above the 20-day MA while MACD shows convergence suggests potential for upward movement toward the upper Bollinger Band in the near term.'

Market Sentiment: Institutional Demand Fuels Ethereum Optimism

Current market sentiment for Ethereum remains strongly bullish amid significant institutional developments. Major headlines include ETHZilla's $250 million buyback authorization and expansion of Ether treasury to $489 million, alongside BitMine's substantial accumulation of 1.7 million ETH tokens with $562 million allocated for further acquisitions. BTCC financial analyst Sophia notes, 'The combination of corporate treasury adoption, large-scale buybacks, and institutional accumulation creates a fundamentally supportive environment for ETH's price appreciation. The shift toward spot purchases and strong DeFi Optimism further reinforces positive momentum.'

Factors Influencing ETH's Price

Ethereum Nears All-Time High Amid Institutional Demand

Ethereum flirts with its $4,953.73 record as institutional inflows signal sustained confidence. The asset now trades at $4,575.06 despite a 6.87% daily dip, with $66 billion in volume suggesting heightened market activity.

ETF investments surged to $341 million on August 25, pushing total managed assets past $30.5 billion. Network metrics reveal growing adoption—active addresses climbed from 300,000 to 432,000 since May, historically a precursor to price appreciation.

Technical charts show consolidation after recent rejection, leaving traders divided between anticipating breakout or correction. The altcoin's $552 billion market cap remains a bellwether for crypto's institutionalization phase.

ETHZilla Authorizes $250M Buyback and Expands Ether Treasury to $489M

ETHZilla (ETHZ) has greenlit a $250 million stock repurchase program, intensifying its ether-centric treasury strategy. The Florida-based firm's board approved the buyback effective immediately, with the program running through June 30, 2026, or until funds are exhausted.

The Nasdaq-listed company now holds 102,237 ETH, acquired at an average price of $3,948.72—worth approximately $489 million at current valuations. It also maintains $215 million in cash equivalents. "Our aggressive repurchase plan at current share prices reflects our commitment to maximizing shareholder value," said Executive Chairman McAndrew Rudisill.

ETHZilla unveiled its proprietary Electric Asset Protocol, designed to generate enhanced yields on crypto holdings. As of August 2025, the firm reported 165.5 million shares outstanding alongside its substantial ETH and cash reserves.

Ethereum Trader Secures $33M Profit Amid Market Shift to Spot Purchases

A prominent trader has closed $450 million worth of Ethereum long positions, locking in $33 million in profits. The move signals a strategic pivot to spot purchases, with the trader acquiring 23,575 ETH for $108 million. Despite the adjustment, 40,212 ETH remains in open long positions.

Ethereum derivatives markets are surging, with trading volume up 145% as options activity drives volatility. The token's price dipped 3.45% to $4,569.22 today, though it maintains a 7.10% weekly gain. Liquidations totaled $295 million, with long positions bearing the brunt.

Bullish sentiment persists despite market turbulence. Positive funding rates and sustained institutional interest suggest confidence in Ethereum's long-term trajectory. The derivatives boom mirrors growing sophistication in crypto markets, where risk management now rivals traditional finance.

Lyno AI Token Presale Shows Strong Investor Demand Amid DeFi Optimism

Lyno AI's early-stage token presale has sold 336,725 units at $0.050 each, raising $16,836 and signaling robust market interest. The project's user-friendly DeFi trading tools draw comparisons to Ethereum's early smart contract potential, with analysts speculating 200x growth this cycle.

Investor enthusiasm appears driven by the platform's accessibility to non-expert traders and its price trajectory—the next presale phase will increase token costs to $0.055, targeting $0.100 ultimately. This demand surge mirrors patterns seen in foundational crypto assets during their incubation periods.

Vitalik Buterin Critiques Prediction Markets’ Lack of Yield for Effective Hedging

Ethereum co-founder Vitalik Buterin has raised concerns about the inefficacy of prediction markets as hedging tools, contrasting their shortcomings with traditional financial instruments. His critique comes amid a bullish surge in ETH's price, which recently hit a new all-time high.

Traditional markets offer standardized hedging products with predictable yields, while prediction markets suffer from fragmented participation and inefficient pricing mechanisms. Buterin specifically highlighted the absence of interest payments—a staple in conventional finance—as a critical flaw undermining their utility for risk management.

The analysis underscores a growing divergence between Ethereum's market performance and the unresolved structural limitations of decentralized prediction platforms. Without yield-generating mechanisms, these markets struggle to attract institutional participants seeking reliable hedging alternatives.

BitMine Expands ETH Holdings to 1.7M Tokens with $562M for Further Acquisitions

BitMine Immersion Technologies (BMNR), the public ether (ETH) treasury company led by Fundstrat's Tom Lee, has aggressively increased its ETH holdings, acquiring over 190,500 tokens last week. The firm now holds 1,713,899 ETH, valued at approximately $7.9 billion at current prices, alongside $562 million in cash for future purchases.

Combined crypto and cash holdings reached $8.8 billion as of late Sunday, assuming an ETH price of $4,800—a significant jump from the previous week's $6.6 billion. However, the recent market downturn saw ETH dip below $4,600, temporarily reducing the stash's value.

BMNR's stock dipped 2.6% in premarket trading after a 12% rally on Friday. High trading volume, averaging $2.8 billion daily last week, has enabled rapid fundraising and ETH accumulation. The company ranks 20th among U.S. stocks by volume, trailing only crypto giant Coinbase (COIN).

BitMine recently filed to raise an additional $20 billion through stock sales, signaling further ambitions in the crypto treasury space.

Weekly Crypto Wrap: YZY Token Volatility, Ethereum's Rally, and Gemini IPO Buzz

The cryptocurrency market witnessed a week of dramatic swings and institutional momentum. Kanye West's YZY token debut became a case study in celebrity crypto volatility, skyrocketing to a $3 billion market cap before collapsing 74% within hours. Analysts flagged concerning centralization, with 87% of supply controlled by a single wallet.

Ethereum solidified its dominance as the institutional favorite, hitting a record $4,953 amid a 12% weekly gain. The rally underscores ETH's growing appeal as the backbone of decentralized finance while Bitcoin's sideways movement continues.

Gemini exchange fueled speculation about becoming the next major crypto IPO candidate, though details remain scarce. Meanwhile, markets digested mixed signals from Jackson Hole - initial enthusiasm gave way to uncertainty as traders parsed Fed rate cut timelines.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, Ethereum shows strong potential for long-term growth. BTCC financial analyst Sophia provides the following projections:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $5,800 - $6,500 | Institutional adoption, ETF developments, scaling solutions |

| 2030 | $12,000 - $18,000 | Mass DeFi adoption, regulatory clarity, ecosystem maturity |

| 2035 | $25,000 - $40,000 | Global settlement layer status, enterprise blockchain integration |

| 2040 | $45,000 - $75,000+ | Store of value narrative, full ecosystem dominance |

These forecasts consider current momentum, institutional accumulation trends, and Ethereum's evolving utility as a blockchain platform. Actual performance may vary based on market conditions and technological developments.